https://www.wemakescholars.com/blog/7-mistakes-that-can-increase-your-education-loan-debt

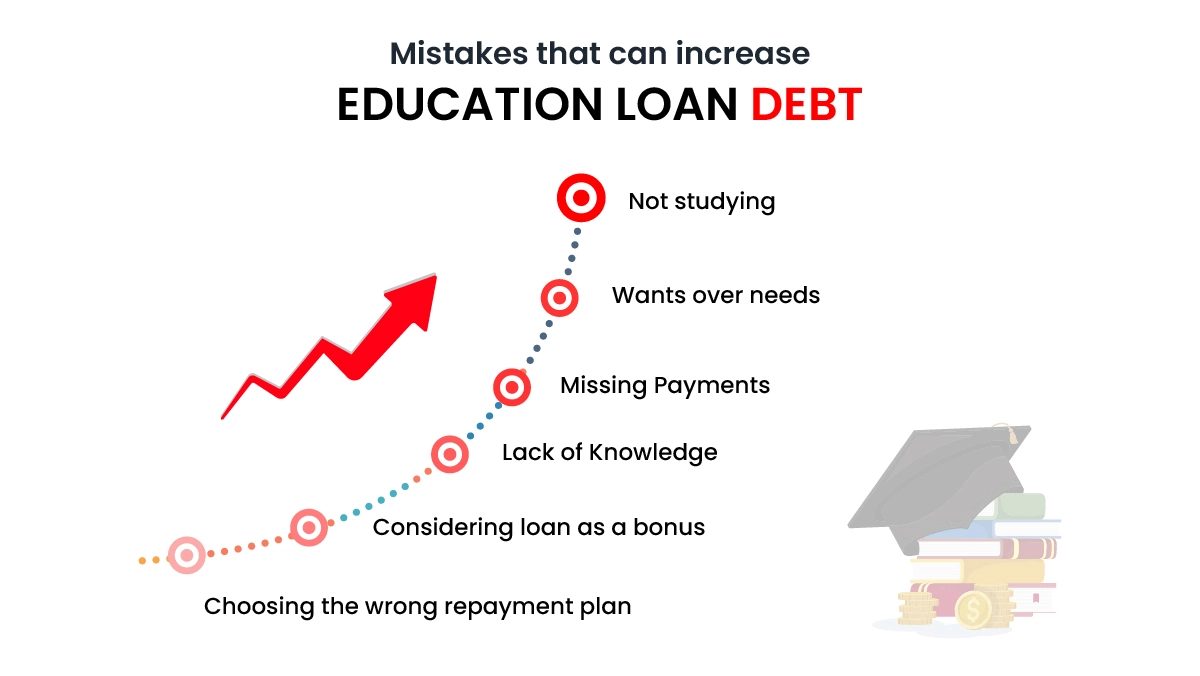

7 Mistakes that can increase your education loan debt

Education Loan Repayment | Updated

The saying “With great power comes great responsibility”, holds true in the case of money as when you have a greater amount of money, you need to be extra cautious. Education loans are meant to cover your educational costs along with your living expenses and travel expenses. The loan is given so as to meet your basic needs and not to live lavishly in a foreign land. In the article below we will discuss some common mistakes that can increase your loan debt.

Proper guidance is what protects one from disaster.

1. Wants over needs:

How many times have we heard the phrase ‘wants are unlimited’? Many times I guess and each time it holds the same amount of significance. Needs can be met and managed, but wants can never be managed. Some students don’t understand this and spend lavishly in a foreign land and then run out of funds and into debt. That is why you need to be smart to differentiate between your needs and wants.

Needs are the essentials that you need to survive while wants are to make your life easier or add more facilities to your life. You need to strictly differentiate between the two to make sure you don’t run out of funds. If you have an extra amount from the loan, then rather than spending that amount on partying or buying lavish stuff for yourself, you can clear your interest during the moratorium period. Avoid the temptation of spending lavishly by thinking about the loan that you will have to repay after your studies.

2. Choosing the wrong repayment plan:

Smaller amounts of EMI per month sound attractive to people, and banks also try to endorse smaller amounts of EMI per month. Wonder, why people and the bank both are on the same page, as it is usually the opposite?

Banks endorse smaller EMIs for a long time to increase the amount that they will receive in the end. People or loan takers prefer smaller EMI plans because they think that a chunk of salary to the EMI will not cost them much, but they are wrong. Smaller amounts for a long time cost you interest for a long time and hence, the amount you will pay at the end is significantly high.

3. Lack of Knowledge:

The students need to be aware of the loan amount, interest rates, type of interest, and repayment options so as to choose the best-suited loan for them. Lack of knowledge can bind you with variable interest rates that keep on increasing from time to time or you may not be able to attain the full amount according to your profile. So you need to be aware of all these factors so as to choose the best loans according to your profile.

Lucky for the students who knew about WeMakeScholars, an organization that provides unbiased education loans to students for higher studies in or out of India. The best part is they provide their services for free and also connect you to suitable lenders according to your profile.

4. Missing Payments:

We understand that sometimes you can miss a payment because of unexpected expenses at the end of the month. But apart from that, you need to be regular with your payments, as late payments or missing a payment will affect your credit score heavily and it will be tough for you to get an education loan in the future. So try to be regular with your payments by keeping the EMI amount ready at the end of the month.

5. Considering loan as a bonus:

There is a difference between a loan and a bonus, which most people misunderstand. When you get a bonus, you don’t have to pay it back as it is yours while loans are provided to help you with finances and you will need to return it to the providers. So do not consider a loan as a bonus or free money which you can spend. It is a liability that you will have to pay back to the providers in the given time, so try to spend it wisely for your studies.

6. Not studying:

Thinking about how can not studying increase your education loan debt? Well, it does. When you don’t concentrate on your studies after taking an education loan, your chances of getting a job become slimmer and so the repayment becomes a lot harder. This is also the reason banks consider hard-working students who will concentrate on their studies, as the probability of loan repayment is a lot higher in students who prefer to concentrate on their studies as they will land a job easily.

7. Opting for low-quality University:

The banks have the best university lists while considering students for education loans. But why? Why do you think banks prefer students who are going to top-ranked universities? The reason is simple, banks are aware of the fact that students going to good universities have a higher probability of getting a good job, and hence repayment chances are also high. In the same way, going to low universities may not land you a job, even if it does, landing a good job is out of the question. So try to go to a good university so you can get a good job and save yourself from debts by paying the loan on time.

The conclusion of the above article is that you need to be smart while spending money of your education loan and also choose a good university and study well so you can pay the loan on time. In case you are planning to take an educational loan, try Wemakescholars by requesting a callback from our team. Wemakescholars provide guidance to students for getting hassle-free education loans from suitable public and private lenders. Our financial officers will get back to you in no time with the best guidance to get an education loan. Request a callback today and get a cashback worth Rs 3000.

Kindly login to comment and ask your questions about Scholarships & Education Loans